- CAPITAL GAINS TAX BRACKETS STOCKS HOW TO

- CAPITAL GAINS TAX BRACKETS STOCKS PROFESSIONAL

- CAPITAL GAINS TAX BRACKETS STOCKS FREE

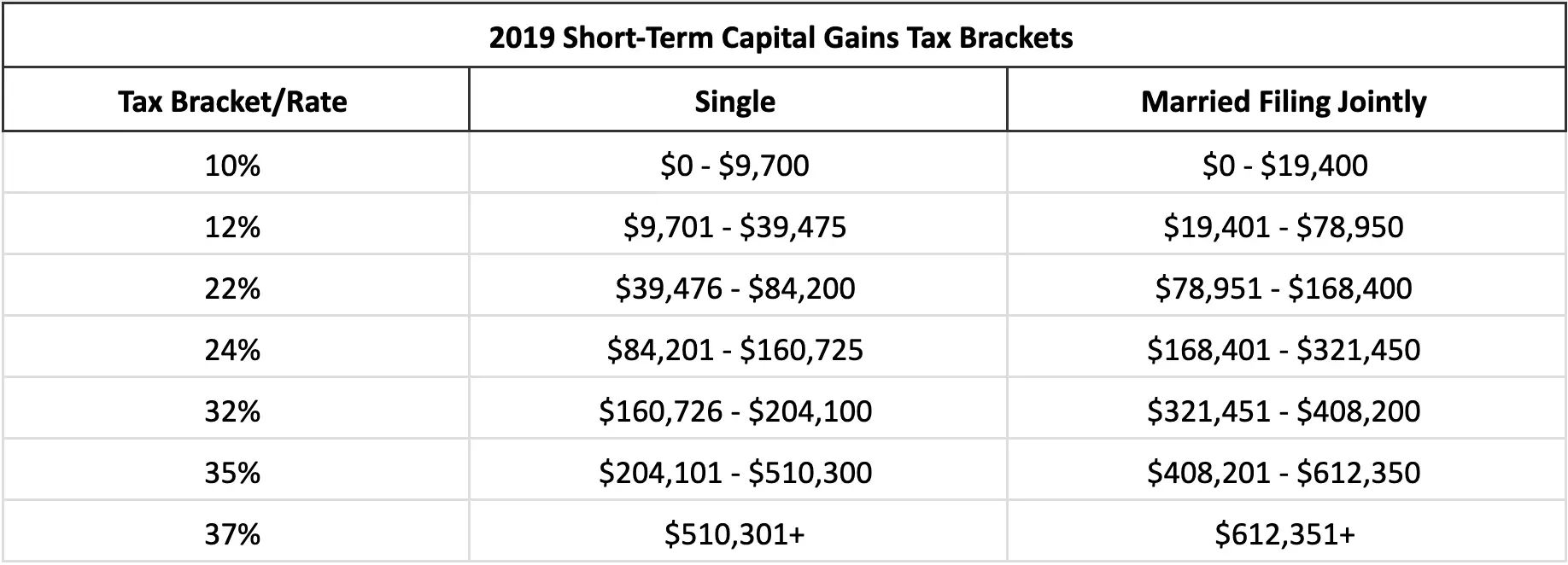

Long-term capital gains tax rates for 2021 are as follows: Short-term gains are taxed as ordinary income. Short-term capital gains come from assets held for under a year.īased on filing status and taxable income, long-term capital gains for tax year 2021 will be taxed at 0%, 15% and 20%. Long-term capital gains come from assets held for over a year. When an investor realizes a capital gain, any proceeds will be considered taxable income.Ĭapital gains vary depending on how long an investor had owned the asset before selling it. Making a profit means the investor now has income, of course, so this must be factored in when filing taxes. Let’s break down the tax rates for your capital gains in 2021.Ĭapital gains refers to the money that an investor makes as the profit from selling one or more of their investments or assets. A financial advisor could help you create a tax plan to maximize your investments. But what some investors may initially neglect to take into account is the fact that investment gains mean investment income, and investment income means taxes on investment income.

CAPITAL GAINS TAX BRACKETS STOCKS FREE

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).One of the draws of investing is the money you could potentially make in a relatively shorter amount of time than earning it through a part-time or full-time job. © Australian Taxation Office for the Commonwealth of Australia

CAPITAL GAINS TAX BRACKETS STOCKS PROFESSIONAL

If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. Make sure you have the information for the right year before making decisions based on that information. Some of the information on this website applies to a specific financial year. If you follow our information and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we will take that into account when determining what action, if any, we should take. We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.

CAPITAL GAINS TAX BRACKETS STOCKS HOW TO

How to calculate capital gains tax (CGT) on your assets, assets that are affected, and the CGT discount. When and how to get your assets valued for CGT purposes.įind out about CGT, including instructions for completing the CGT section of the individual income tax return. Relationship breakdown and capital gains taxįind out if you can defer, or 'roll over', CGT on assets that transfer to you in a divorce. How CGT affects your assets if you are a foreign or temporary resident, or change your residency.

How and when CGT applies if you sell assets you inherited, including properties and shares. How CGT affects real estate, including rental properties, land, improvements and your home.Ĭheck if you are an investor or trader, and how it affects tax on your shares or units in a fund. Use the calculator or steps to work out your CGT, including your capital proceeds and cost base. How and when CGT is triggered, such as when an asset is sold, lost or destroyed.įind out if your asset is eligible for the 50% CGT discount. How capital gains tax (CGT) works, and how you report and pay tax on capital gains when you sell assets.Ĭheck if your assets are subject to CGT, exempt, or pre-date CGT.Įstablish the date you buy or acquire an asset, your share of ownership and records to keep.

0 kommentar(er)

0 kommentar(er)